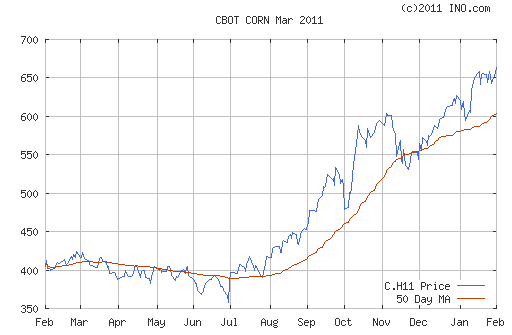

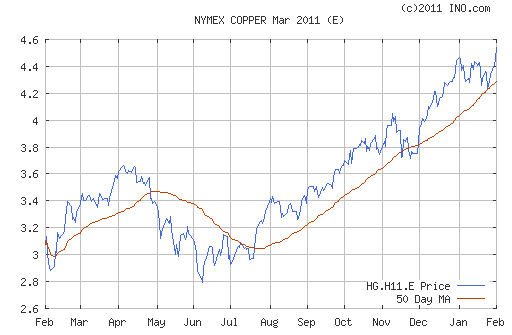

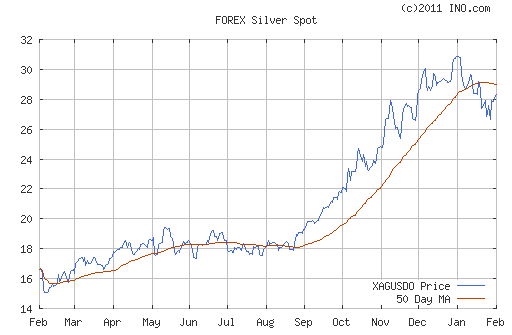

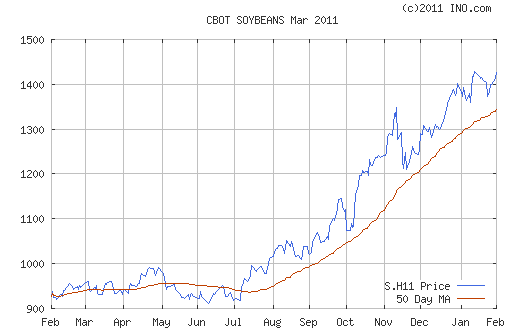

It’s gearing up for the next round of financial crisis. While our so-called leaders have enjoyed their annual back-patting exercise at Davos, I have become exceedingly alarmed by what’s currently going on in the commodities markets. Food, energy and metals have all sky-rocketed during the last five or so months. While the financial markets have seen a 20% increase during that period, and this is touted as “the crisis is over”, the prices of raw materials have increased 50-100%. These are the real inputs that the economy and indeed our lives depend on.

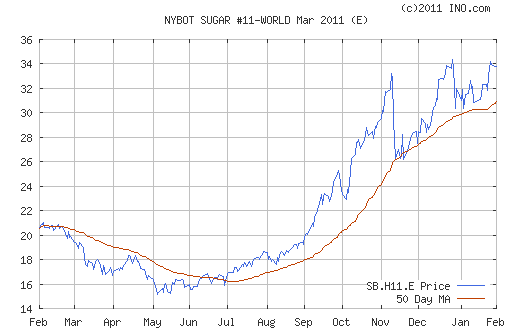

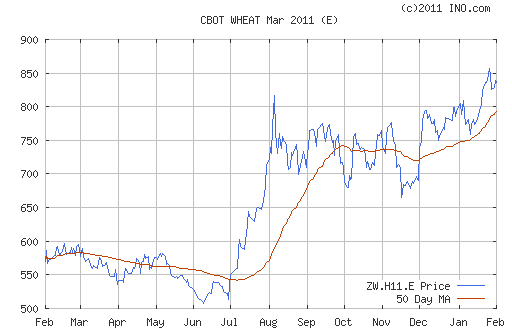

Let’s look at some numbers:

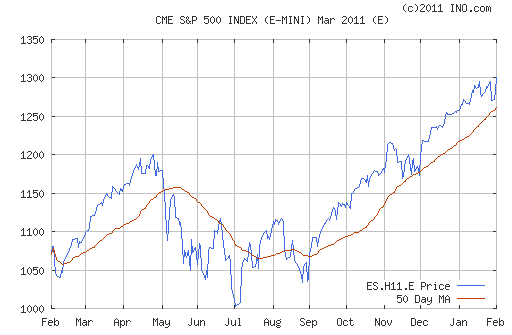

And what has the S&P done?

This is looking to me like a very unhealthy market. It’s like the high commodities prices of the first half of 2008 all over again. Only this time, the economy is probably a lot less resilient towards high prices. If the economy tanks again, what instruments remain to bail it out? The “wealthy” nations of the world are already running close to 0% interest rates, and are up to their ears in debt. Printing money, as has already been done, is a surefire way to boost commodities even higher. Peak oil, the climate crisis (drought brought forth some of the high grain prices seen above) and general resource depletion are all converging to shake the foundations of our debt-based consumerist society.

The Davos growthsters have only one plan: Returning to the good old years of growth by “stimulating” the economy by ever more illusional money.

I have another idea: It’s time to question that old growth gospel and stop borrowing money and natural resources from our future.